News

Conroe ISD Trustees Adopt 2022-23 Budget & Tax Rate

CONROE, TX – The Conroe ISD Board of Trustees approved the 2022-2023 proposed budget and tax rate at their August meeting. Key objectives of the proposed budget include meeting the needs for the 2022-23 school year, providing a competitive compensation plan, and continued support for maintaining a safe environment for students and staff.

Of the approved $619,827,991 budget, over 89% is for employee salaries given that Conroe ISD is the largest employer in Montgomery County with over 8,700 employees. When including substitutes, there are over 10,000 employees in the District.

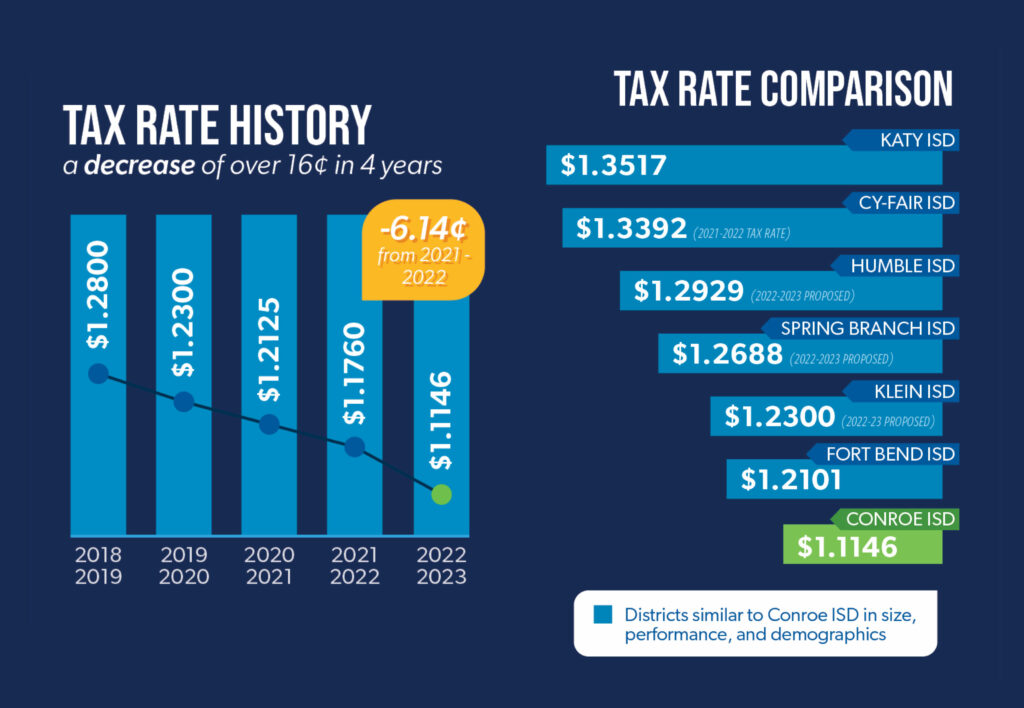

CFO Darrin Rice also presented information on the now approved tax rate of $1.1146, which is 6.14 cents lower than the 2021-2022 tax rate of $1.1760, a decrease in over 16 cents in the last four years, and Conroe ISD’s lowest rate since 1988. With the new rate, Conroe ISD continues to have the lowest tax rate when compared to surrounding districts that are similar in size, performance, and demographics and the second lowest tax rate in the greater Houston area.

For the third consecutive year, Conroe ISD has been named by Education Resource Group as the 2nd highest rated district out of the 200 largest districts in the State for academic and financial performance. Conroe ISD has also received the highest recognition for transparency from the Texas Comptroller of Public Accounts for 10 years in a row and is one of two districts in Texas to receive five stars every year for 12 years from TxSmartSchools for high academic achievement while maintaining cost-effective operations.

To view the budget presentation, please visit Conroe ISD’s YouTube Channel. For more information about the District, please visit www.conroeisd.net.